The experience of local Citizens Advice gives a unique, fresh insight into the problems faced every day by people living in the UK.

The experience of local Citizens Advice gives a unique, fresh insight into the problems faced every day by people living in the UK.

As well giving advice we also use what we see and hear to prevent problems in the first place. The stories clients share with Wiltshire Citizens Advice gives us a unique insight into the problems faced by people in Wiltshire.

With over two million clients seen in England and Wales each year by the Citizens Advice service it's the kind of evidence that's hard to ignore. It's all too apparent when policies and services cause people problems.

We see it as our responsibility to create a public debate around these issues and to speak up for clients.

Citizens Advice, locally and nationally, collects evidence of clients' problems and uses this to campaign for changes in national and local policies and services. We have a key role in speaking up for clients, raising issues brought to us, contributing to public debate and informing legislation.

The policy / campaign work of the Citizens Advice service covers a huge range of issues including consumer, debt, housing, benefits, immigration, employment, legal matters and health. We work with policymakers, regulators, MPs, and service providers.

Helping to help more people than the people we see

Everyone is affected by rules and principles which shape the services and benefits we all rely on. These may include regulations, codes of practice, legislation, guidelines and policies of service providers; they may be national, regional or local. All social policy work undertaken is rooted in the experiences of real people who are adversely affected by these policies; social policy is about campaigning to bring about changes to make the rules (and their implementation) fairer for all.

The Citizens Advice service has built a strong reputation for independent analysis and has worked with government, companies, regulators, trade associations and consumer groups to secure change for those who are adversely affected by unfair policies.

It is recognised that the best way to tackle any problem is to treat the cause, not just the symptoms. This is what social policy aims to do. We cannot see everyone who needs help individually and many people do not access our services, for various reasons. However, we can - and do - reach out and help people beyond our core service users through our social policy work, by bringing about changes that reduce unfairness.

Current campaigns and research

The housing crisis in Wiltshire

- Unfreeze the Local Housing Allowance and restore the link to local rents, returning it to the 30th percentile.

- Strengthen Minimum Energy Efficiency Standards in legislation, so all new private rented properties reach EPC C by 2025, and existing tenancies by 2028.

- Extend Awaab’s law to the private rented sector to place strict timelines on landlords to deal with serious issues such as damp and mould.

- Bring forward the Renters’ Reform Bill to, amongst other things, abolish section 21 evictions, give tenants stronger powers to challenge poor practice and extend the Decent Homes Standard to the private rented sector.

- Ensure that Local Authorities have well-resourced teams to enforce quality standards set out in the Bill and that these teams are accessible to tenants.

Recent research and campaigns

Cost of Living Crisis

-

Reduce the immediate financial pressure low income households will feel in April. The best way of doing this quickly is through a one-off payment via the benefits system.

-

Spread the cost of energy supplier failures over a longer period (2-3 years) rather than current plans (recovering the majority in 2022/3)

-

Uprate benefits in line with current inflation, offset by lower increases in the following financial year (with the overall impact of the change being cost neutral).

-

Recognise this crisis will stretch through to next winter - when the risks from cold weather are greatest - and start developing solutions now. By increasing and extending the Winter 2022 Warm Home Discount we can have the provision in place that will protect the lowest income households from the worst excesses of the coming price increases.

Need advice?

If you're worried about rising energy costs, struggling to pay your bills, or would like information about support schemes to help lower your energy costs please contact us.

Keep the Lifeline

January 2021

We urged the Government to keep the £20 uplift to Universal Credit.

In the lead up to the Spring Budget, we urged the Government to keep this lifeline in place to support families who need it through the rest of the crisis and our recovery, as well as ensuring we have an adequate social security system for the future.

We also urged the Government to make this much-needed £20 per week uplift to Universal Credit and Working Tax Credits permanent, and extend it to legacy claimants so that this group, who are mainly disabled, sick and carers, don’t continue to be excluded.

You can follow the #KeepTheLifeline campaign on Twitter.

Employment issues in Wiltshire during Covid-19

August 2020

We are facing the worst jobs crisis for a generation. Citizens Advice research shows 1 in 6 (17%) are facing redundancy. A recent YouGov poll revealed more than a third of UK employers plan to make staff redundant over the next three months. Hundreds of thousands more have already lost their jobs - people like Lottie*.

We are facing the worst jobs crisis for a generation. Citizens Advice research shows 1 in 6 (17%) are facing redundancy. A recent YouGov poll revealed more than a third of UK employers plan to make staff redundant over the next three months. Hundreds of thousands more have already lost their jobs - people like Lottie*.

Lottie* has asthma and faces potentially higher risks from coronavirus so she was furloughed by her employer at a local nursery, where she’s worked for the past year and a half. Lottie has now been made redundant, with one week’s notice. She did not receive any redundancy pay and has no savings. Lottie turned to us as she worried how she would manage to look after her family and pay the rent.

We’re helping people like Lottie once every two minutes with a redundancy problem. In July 2020, we helped six times the number of people with a redundancy problem than we had the previous year.

The labour market is in a perilous state, kept afloat by the Job Retention Scheme, the single biggest peacetime intervention in the economy in history. But even that has not proved enough to hold all jobs in stasis. Employment fell by 730,000 in July, with the youngest and oldest workers hardest hit by redundancies thus far. Those aged 16 to 24 years in the labour market decreased by 100,000, while those aged 65 years and over decreased by a record 161,000 from April to June 2020.

The number of people claiming benefits who were not in work has risen to the highest levels for 20 years. And the total number of hours worked has fallen by almost 9%, the fastest decline on record. Every indicator seems to break new records in highlighting how profoundly the coronavirus pandemic has damaged the economy and people’s jobs.

Alongside this sobering picture, we can add our own insights from the problems people are coming to us about. The retention scheme formally runs until the end of October, but employers, who since August have faced the requirement to make contributions and statutory timescales for redundancies, will feel the financial pressure to make decisions now.

Our new report, which you can download below, summarises the redundancy issues and other employment problems we’re supporting people with in this jobs crisis; and how this is affecting people’s finances and ability to pay their rent, council tax and other household bills now and in the future.

*Client name has been changed.

Seven things to check if you’re at risk of redundancy

We have helped people with a huge range of issues since lockdown, but we know that as the furlough scheme winds down, lots of people may be feeling worried and need advice.

If you’re at risk of redundancy, it’s important to know you do have rights to help protect you from unfair dismissal and to ensure you’re paid what you’re owed.

Click here to see our seven things to check if you’re at risk of redundancy

Fixing Universal Credit

Why Universal Credit matters

Why Universal Credit matters

By 2022, 7 million families in the UK will be on Universal Credit. Over half of those will be in work.

The aim – to simplify our benefits system – is right. But Universal Credit is already failing many people.

It is forcing people into debt and leaving them without the means to make ends meet.

At Citizens Advice across the country we’re already helping thousands of people who are claiming Universal Credit.

If the problems with Universal Credit aren’t fixed they will escalate. That’s why we’ve been campaigning for the Government to address the issues with Universal Credit before this happens.

If they don’t, 7 million households will face serious financial risk.

Campaigning to fix problems with Universal Credit

Since Universal Credit was introduced we’ve used our clients’ evidence to help us persuade the Government to make changes that ensure UC works for the people who need it.

Locally and nationally Citizens Advice have been campaigning since July 2017 for the government to pause and fix Universal Credit.

This is because our evidence shows that Universal Credit can leave people unable to pay essential bills and can risk pushing them into debt and hardship whilst they wait for their first payment.

Campaign successes

In November’s Budget, the Government announced a number of changes, including a £1.5 billion package of support for UC. These changes should make a significant difference to the millions of people who will be claiming UC by the time it’s fully implemented. We will continue to keep a close eye on the roll-out of UC and make sure they do.

The changes include:

- Removing the 7 waiting days

- Introducing an additional non-repayable financial payment for those moving from Housing Benefit to UC to help people pay their rent.

- Changes to Advance Payments so claimants can receive 100% of their payment as an advance, and pay it back over 12 months. All claimants should be told they can get an Advance Payment

- Making the UC helpline free

- A slowdown in the roll out of full service UC

- Closure of new claims to the ‘live service’

The Government will be looking again at Universal Support to ensure those who need it are helped to get onto UC and to adapt to the changes involved, and wider changes to UC and the taper rate are under review.

We’ve called for all these changes in recent months and believe they will make a real difference to the people we help.

Read more about our campaign to fix Universal Credit

Past research

Housing: There's no place like home

What’s it like trying to make a home in Wiltshire and how does the national housing crisis present itself in our county?

What’s it like trying to make a home in Wiltshire and how does the national housing crisis present itself in our county?Wiltshire Citizens Advice has been addressing this question over the past two years in a research study based on actual feelings and experiences. This briefing (available to download below) is not a detailed report on our research, largely because many of the issues identified remain unresolved and therefore our research must be ongoing. Rather, it constitutes the key messages and recommendations from our findings to date.

This briefing is intended for those who would like greater understanding of people's broad and inclusive housing needs, together with how these work alongside the provision available in Wiltshire.

Our contributors; including clients coping with housing issues, interested members of the public, staff and professionals whose daily work involves advising, representing or helping them; offer both operational and strategic housing insights that should be useful to all working in housing across Wiltshire.

We recognise that our ‘client-eye-view of Wiltshire’s housing’ may be coloured by impending loss of a home or the threat of homelessness, but argue its relevance to any county-wide housing policy. We also interviewed people who had voluntarily walked into our offices from ‘street-level’ to talk to us about what they thought made a successful and sustainable home.

We have archived a more than 30,000 recorded words, in response to +80 different interview questions and a broad range of interviewees also included people working in legal representation, Local Authority, social housing allocation and clients struggling with the threat of eviction, or trying to gain a foothold in the rented sector (both social and private). All Wiltshire Citizens Advice staff have had an opportunity to contribute ideas from their first-hand experience. The rich data collected through our research study will be utilised in taking forward the recommendations contained within this briefing.

The conclusions and recommendations which follow, are a result of this effort. As a strategy to simplify matters, and help eliminate any confusion, the conclusions are divided into the strategic and operational.

Need housing advice?

Other past campaign successes

Over the years we have campaigned on a range of different issues in order to improve the policies and services that affect our clients. These are just a handful of the campaigns we are most proud of.

Making Employment and Support Allowance (ESA) #FitforWork

What was the problem?

What happened?

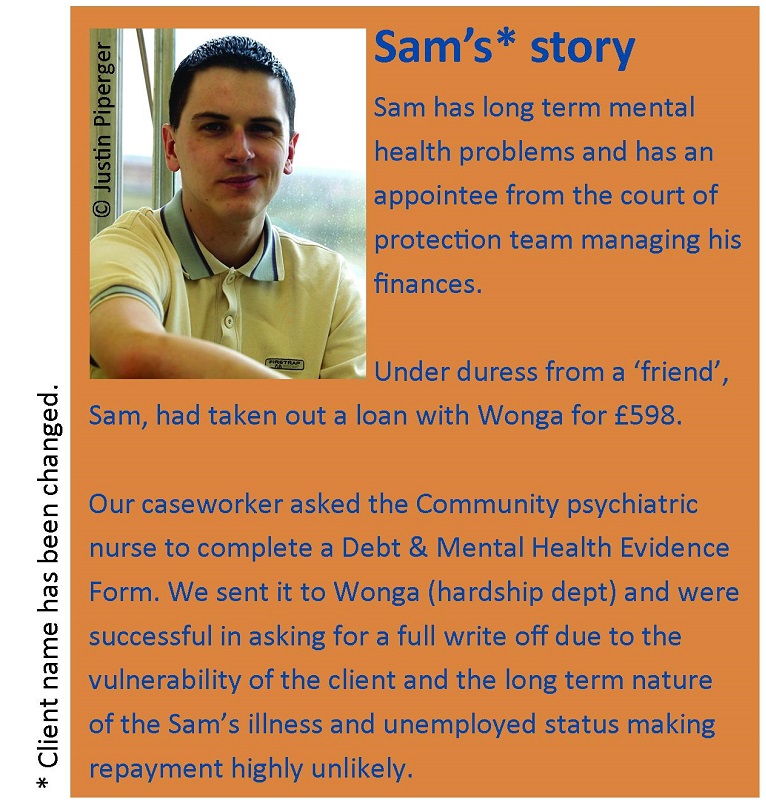

Payday loans campaign

What was the problem?

How we got involved

Advertising practices under the microscope: Complaints were made about several payday loan ads and a number have already been banned.

Read more about how our clients and the wider public have benefitted from our successful campaigns - campaign successes.

Research and campaigning with us

Interested in being a local campaigner or researcher with Wiltshire Citizens Advice? Find out how you can volunteer with our research and campaigning team.